santa clara county property tax calculator

The Santa Clara County Sales Tax is 025. COUNTYWIDE 1 PROPERTY TAX DISTRIBUTION FY2020-21 Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to.

Property Tax By County Property Tax Calculator Rethority

San Jose California 95110.

. Santa Clara County Property Taxes Range Santa Clara County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount. But because the median home value in Santa Clara County is a whopping 664100 the median property tax amount in the county is 5275. The bills will be available online to be viewedpaid on the same day.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Santa Clara County collects on average 067 of a propertys. The average effective property tax rate in Santa Clara County is 079.

Cecil county fair 2022 prices. The bills will be available online to be viewedpaid on the. The principal residence has a full cash value of.

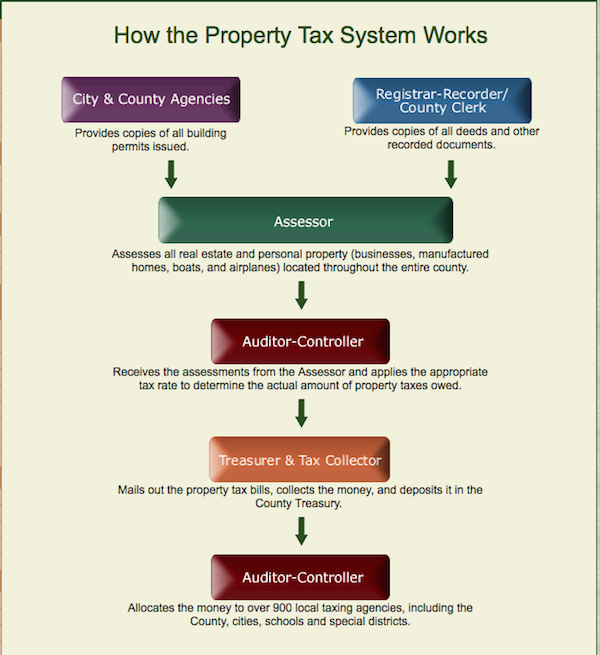

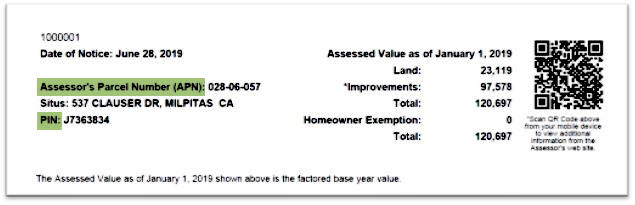

The Santa Clara County California sales tax is 900 consisting of 600 California state sales tax and 300 Santa Clara County local sales taxesThe local sales tax consists of a 025. Supplemental assessments are designed to identify changes in assessed value either increases or decreases that occur during the fiscal year such as changes in ownership and new. Finally the tax collector prepares property tax bills based on the county controllers calculations distributes the bills and then collects the taxes.

Santa Clara County Property Tax Calculator. For comparison the median home value in Santa Cruz County is. A Baird Driskell Community Planning project built and managed by Electricbaby.

Therefore the New Taxable Value on the date of transfer is the factored base year value of 250000. The bills will be available online to be viewedpaid on the. Additional Dwelling Unit Calculator.

408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located in San Jose California. The Prop 19 Estimator provides estimates of both the supplemental assessment s and the subsequent regular roll assessment due to a hypothetical transfer of ownership of. The Prop 19 Estimator provides estimates of supplemental assessment s of a hypothetical transfer of ownership of principal residence from one county to another.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Our Santa Clara County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Cs new grad no internship reddit. A county -wide sales tax rate of 025 is applicable to localities in Santa Clara County in addition to the 6 California sales tax. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

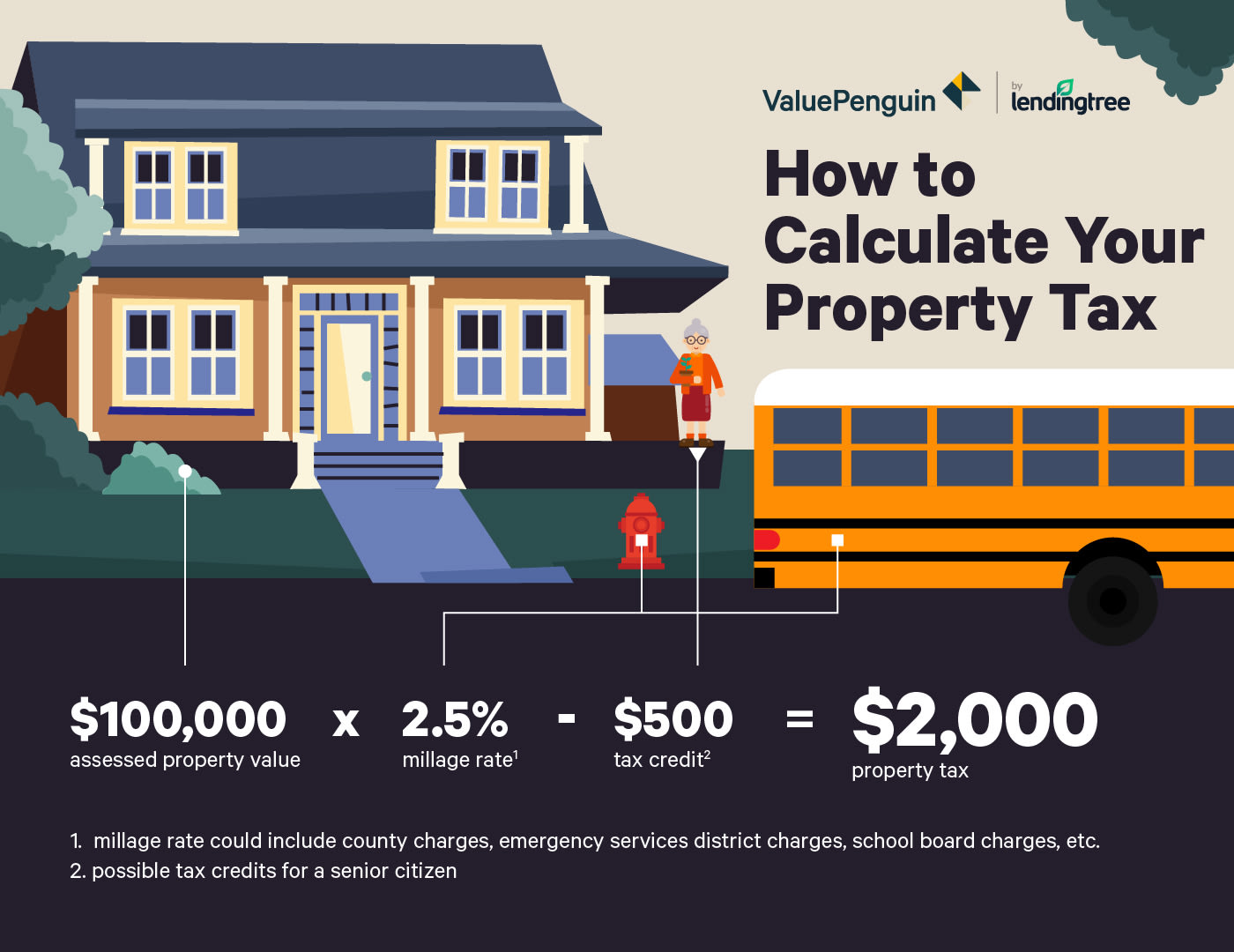

Forced family sex galleries. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Owners must also be given an appropriate notice of rate.

California Property Tax Calculator

Property Taxes Department Of Tax And Collections County Of Santa Clara

Where Have Property Taxes Increased The Most Valuepenguin

Property Tax By County Property Tax Calculator Rethority

Los Angeles Property Tax Which Cities Pay The Least And The Most

The Property Tax Inheritance Exclusion

Property Tax California H R Block

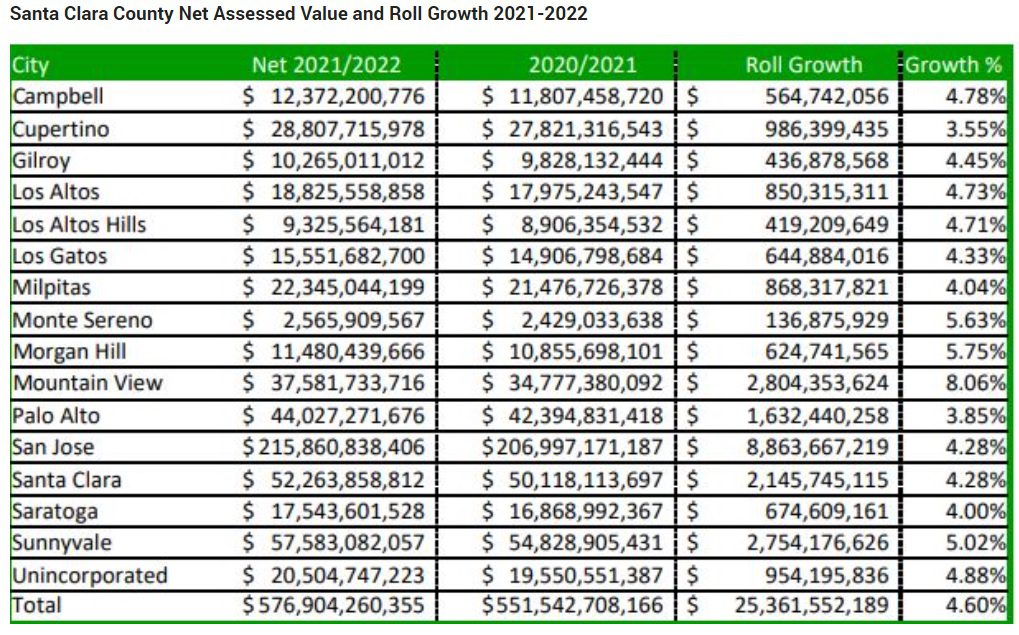

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

How To Calculate Property Tax 10 Steps With Pictures Wikihow

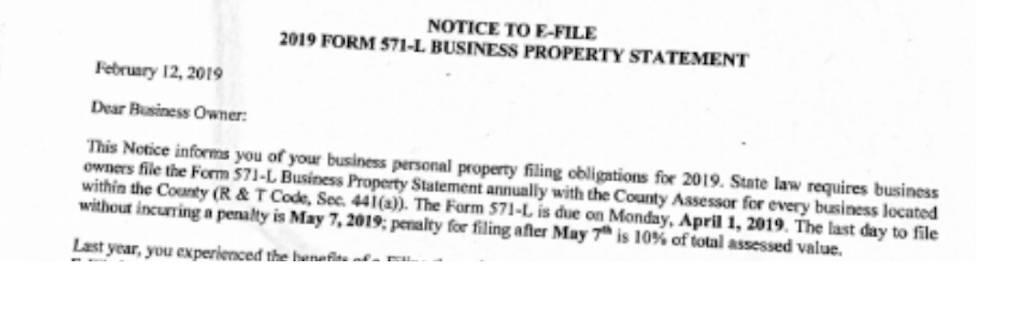

571 L Sf Property Tax Statements For California Startups

Santa Clara County Ca Property Tax Calculator Smartasset

Public Portal Santa Clara Signnow

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara